insights

The Ultimate Guide to Demand Forecasting, Powered by Mo

Lakhveer Singh Jajj — Founder & CEO

Every great ops decision starts with a clear forecast. Without it, even the strongest strategy is left vulnerable to guesswork.

In today's volatile landscape, where demand can shift overnight, the companies that stay ahead are the ones preparing before change hits. Strong forecasting turns that uncertainty into structure, aligning inventory, supply chain, and financial choices around what’s next.

This guide breaks down the core types of demand forecasting, shows how to match each method to the right planning moment, and demonstrates how Mo — Moselle's AI-informed inventory planning companion — helps high-growth brands turn raw data into accurate, bottom-up plans they can confidently put into action.

Forecasting Fundamentals: Types, Methods, and What to Use When

Before running any model, start by clarifying your planning goals. Are you looking to replenish stock for the coming month? Assess cash flow for the next quarter? Fundraise for next year? Each objective demands a different lens on future demand.

The type of forecast you choose establishes the scope and horizon of your plan, while the method you apply determines the path you'll take to reach it. Together, they shape the accuracy and usefulness of every decision that follows.

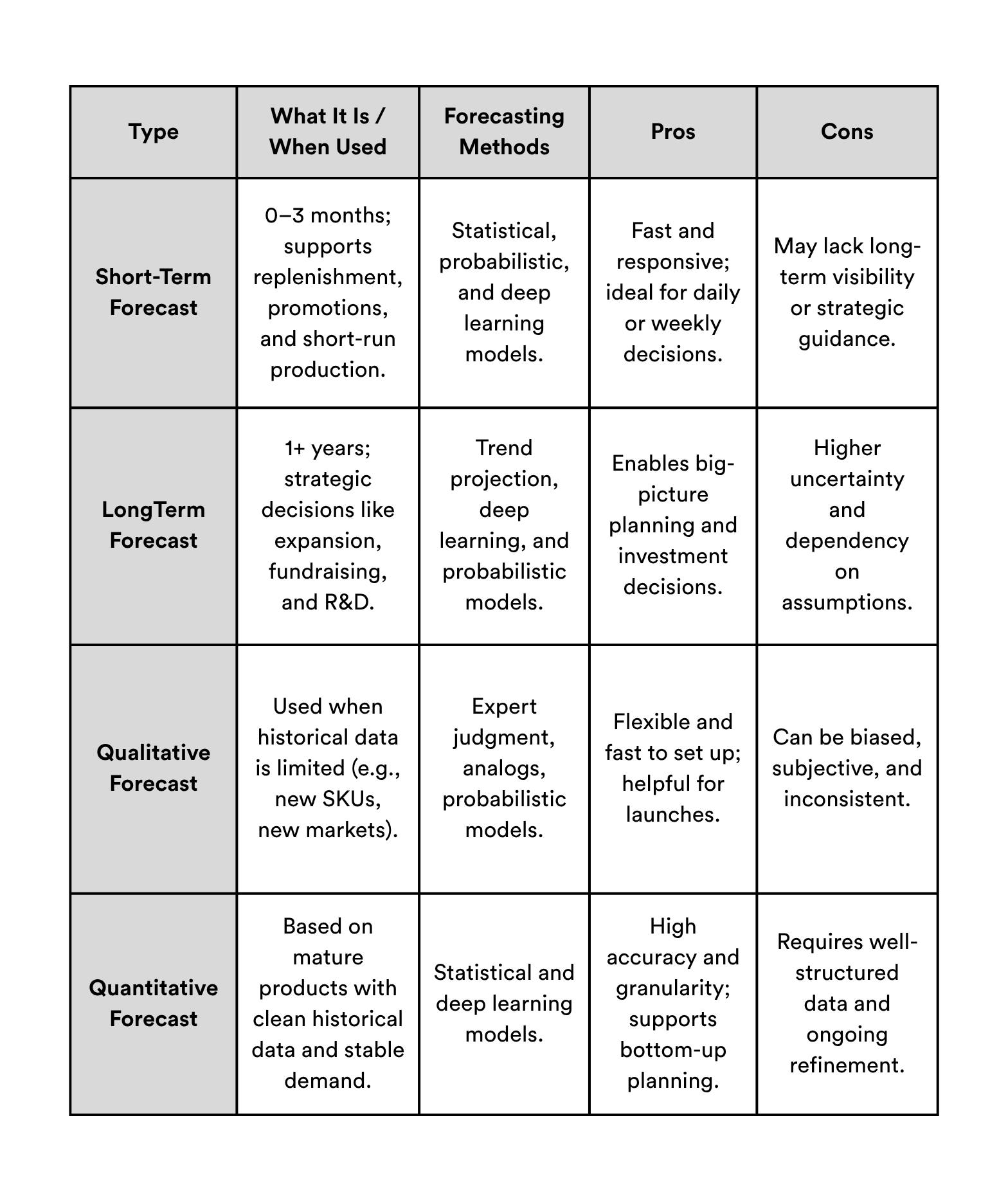

Types of Forecasting

Broadly, forecasting falls into a few key categories:

- Short-term (0–3 months): Best for replenishment, promotions, and short-run production planning.

- Long-term (1+ years): Useful for strategic decisions like expansion, fundraising, or R&D.

- Qualitative: Ideal for new products or markets where you lack historical data.

- Quantitative: Effective for mature products with stable demand and historical sales trends.

No single type covers every scenario, but when you match the right approach to the right planning moment, you create forecasts that are both practical for today and reliable for the future.

Forecasting Methods

Once you've identified the type of forecast you need, the next step is choosing the method that best fits your goals and data. Different approaches serve different purposes — from simple historical projections to advanced AI-informed models that adapt in real time.

Statistical Models

Statistical models use historical sales patterns to forecast future demand. They're best for short-term, quantitative planning, where past performance can reliably guide near-term decisions. These models work especially well for SKUs with steady, predictable demand — when yesterday's trends are strong signals for tomorrow's needs.

Trend Projection

Trend projection looks beyond last month's numbers to highlight broader patterns — like seasonality or steady growth. It's best for long-term, quantitative forecasting, giving brands visibility 6, 12, or even 18 months out. With that view, teams can make confident decisions about scaling production, preparing new launches, or expanding into new markets.

Probabilistic Models

Probabilistic models step in when plans get unpredictable — like promotions, new launches, or sudden surges. Instead of a single number, they predict a range of possible outcomes, making them useful for both short- and long-term planning. Teams can test different "what if" scenarios and see instantly how changes in demand, timing, or assumptions would affect the forecast.

Deep Learning

Deep learning models pick up subtle signals and unexpected relationships across SKUs, channels, and markets. They're powerful enough to guide both short- and long-term planning, automatically adapting as new data comes in. For fast-growing brands, this adaptability means sharper forecasts and smarter decisions that keep pace with rising complexity.

Choosing the method depends on your planning horizon, the quality of your available data, and the complexity you need to capture. Many brands combine methods — for example, they lean on statistical models for stability while layering in deep learning or probabilistic models to handle uncertainty and rapid growth.

At-A-Glance: What to Use and When

Different Challenges Call for Different Forecasting Approaches — Here's How to Choose

Forecasting only matters when it solves the real challenges your business faces. Choosing carefully can mean the difference between protecting margins during volatile demand or preserving the customer experience when stock is at risk.

That's where Mo comes in. As your interactive planning partner, Mo takes the guesswork out of choosing an approach, offering instant guidance on which model fits your specific situation.

Launching a New Product

New products are exciting, but they also bring the most uncertainty. Without historical sales data, brands are often left guessing demand for fresh SKUs — risking overspending on inventory or missing early sales momentum.

- Forecasting approach: Qualitative and short-term.

- Forecasting method: Analog-based estimation and probabilistic models.

- Why: No past data means no standard forecast — and human bias can unintentionally make manual projections even less reliable.

- How: Use similar SKUs or categories to guide assumptions, layered with probabilistic ranges to account for uncertainty.

- Mo tip: Ask Mo to suggest models based on comparable launches and seasonality.

Planning BFCM Inventory

Few moments put as much pressure on forecasts as Black Friday/Cyber Monday. Timelines are short, demand is unpredictable, and poor planning can mean either missed revenue or excess inventory during the most critical selling period of the year.

- Forecasting approach: Quantitative and short-term.

- Forecasting method: Scenario planning with probabilistic models.

- Why: High stakes, short window, unpredictable lift. Manual forecasts quickly become outdated — by the time spreadsheet models are updated, market conditions have already moved on.

- How: Build multiple scenarios with adjustable lift assumptions and order timing.

- Mo tip: Say "Plan a 15% YoY lift for our top 20 SKUs" — Mo handles the rest.

Launching a New Sales Channel

Even when you know your SKUs inside out, introducing a new sales channel — like adding Amazon, wholesale, or retail to your DTC mix — brings fresh uncertainty. Each channel has unique customer behavior, seasonality, and velocity patterns that can reshape demand in surprising ways.

- Forecasting approach: Qualitative and long-term.

- Forecasting method: Trend projection and manual research.

- Why: Even proven SKUs can perform differently across channels depending on pricing, visibility, and promotions.

- How: Use data from similar SKUs or adjacent channels to guide assumptions, then layer in trend projections to anticipate channel-specific demand patterns.

- Mo tip: Mo highlights missing signals between channels and recommends modifiers to align forecasts with each channel's sales cadence.

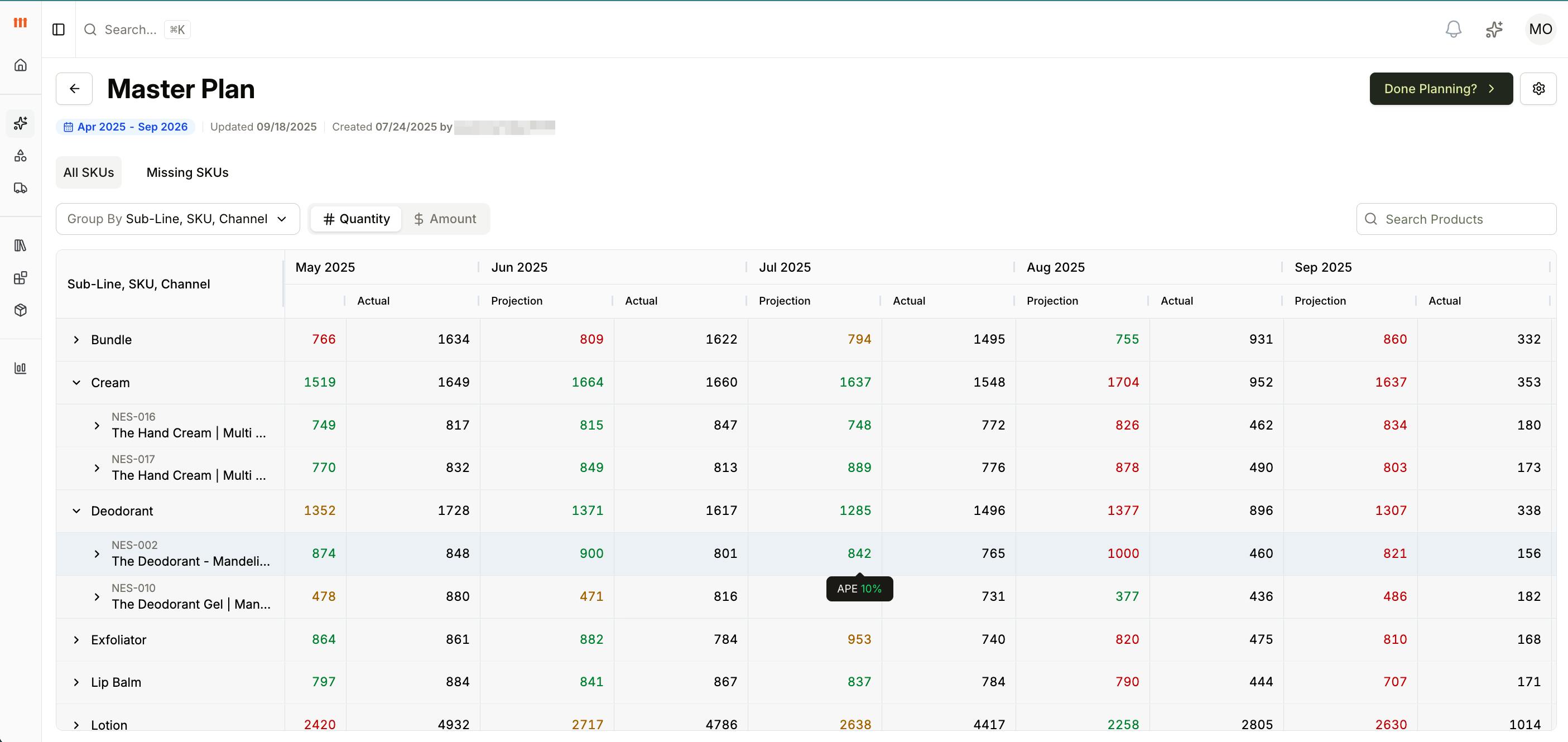

Managing Stock for Top SKUs

Core products carry the business. Stockouts drain revenue, while overstocking ties up cash. For top-selling SKUs, you need highly responsive forecasts that keep supply in lockstep with demand.

- Forecasting approach: Quantitative and short-term.

- Forecasting method: Statistical models and bottom-up forecasting.

- Why: These SKUs drive core revenue — you need tight control. Manual tracking can’t keep pace with daily demand shifts.

- How: Use historical sales patterns and replenishment cadences for accurate, daily-level predictions.

- Mo tip: Automate daily updates with Lightning Forecasting Flow.

Prepping for Supply Chain Risks

No matter how strong the plan, supply chains face disruptions — whether vendor issues, shipping delays, or sudden allocation shifts. Rigid forecasts can't keep up, so flexibility becomes essential.

- Forecasting approach: Qualitative and long-term planning.

- Forecasting method: Probabilistic models.

- Why: You need flexible scenarios for disruption.

- How: Simulate risk-adjusted scenarios for lead time delays, vendor issues, or allocation shifts.

- Mo tip: Ask Mo: "Build me a conservative scenario if lead times stretch by 2 weeks."

Retail Forecasting With SPS Data

Wholesale adds another layer of complexity: sell-in vs. sell-through performance varies widely by retailer and even by door. Without clarity across SPS data, teams are left piecing together fragmented retailer reports. Missing or delayed sell-through signals make it easy to overstock some locations while understocking others.

- Forecasting approach: Quantitative (sell-in) and qualitative (sell-through).

- Forecasting method: Trend projection and manual override.

- Why: Retailer demand drives wholesale POs — and doors perform differently.

- How: Use 850 sell-in data to forecast retailer reorders, and sell-through to shape by-location plans.

- Mo tip: Mo surfaces these retail trends directly — no extra digging required.

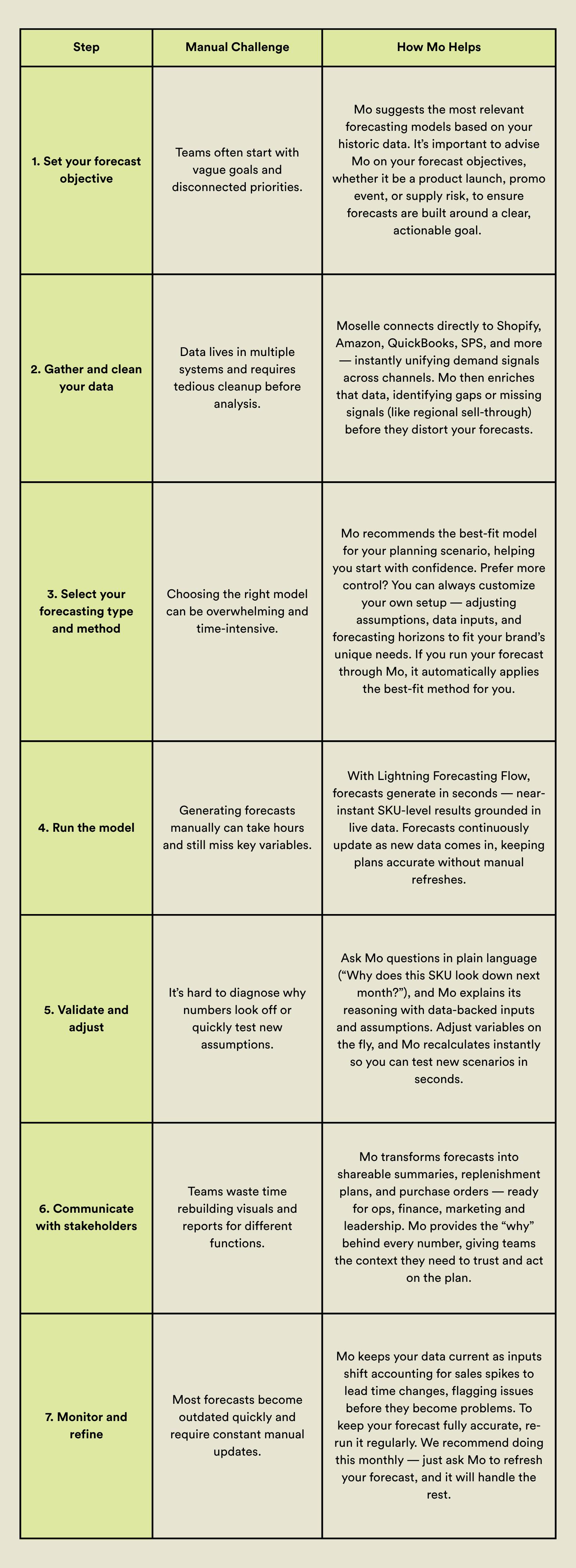

The 7 Steps to Accurate, Scalable Forecasting

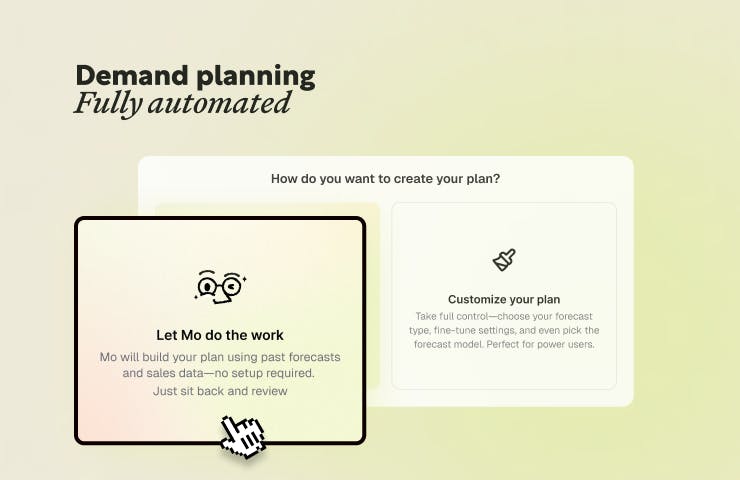

Building a forecast once meant juggling spreadsheets and second-guessing every number. With Mo, the process becomes faster, smarter, and far more reliable. Here's how each step transforms when you move from manual work to modern forecasting.

Planning for Promotional Peaks With Mo

Big promotional moments — like the holiday season, Black Friday/Cyber Monday, Boxing Day, or Sephora Sales — can make or break your forecast. These periods bring short, high-volume bursts of demand that strain even the most careful plans.

Here's what it looks like to plan one with Mo.

Instead of wrangling data across tools, you open Moselle and type: "Build me a holiday forecast for our top 10 SKUs with a 30-day runway and 15% lift."

Mo immediately recognizes the goal and pulls live sales data from Shopify and Amazon. As it reviews the data, it flags SKUs with inconsistent performance and asks if you’d like to apply a weighted average. With a quick approval, Mo recommends using a probabilistic model to account for promotional lift.

Within seconds, you're looking at a SKU-by-SKU projection. One number catches your eye, so you ask: "Why is SKU-104 lower than last year?"

Mo responds with historical data from the same promo period — highlighting a stockout that impacted last year's results. With that context, you adjust the lift assumption by 10%, rerun the forecast, and lock it in.

From there, turning the forecast into action takes just a few clicks. You generate a replenishment plan, review the suggested purchase order, and send it to your supplier — all within the platform. And because Mo syncs with your live sales channels, your promotional forecasts stay current as demand shifts.

Ready to Automate Your Forecast? Let Moselle do the Heavy Lifting

Scaling your brand doesn't have to mean scaling your headcount. Moselle's AI-informed inventory planning companion, Mo, is your operations partner — giving fast-growing teams enterprise-level forecasting power without adding complexity.

With Moselle, every part of planning connects seamlessly — from forecasting to production to replenishment — eliminating the need to juggle disconnected tools.

- Automation takes center stage, generating demand and production forecasts in seconds and updating automatically as sales data shifts.

- Moselle's direct integration with Shopify, Amazon, QuickBooks, SPS, and other ERPs and WMS unifies ecommerce, retail, and B2B inputs into one complete operational view.

- Planning is dynamic and responsive. Teams can monitor stock in real time, receive proactive alerts, and trigger replenishment before gaps appear.

- Unlimited scenario planning makes it easy to test "what if" models and instantly see recalculated outcomes.

- At every step, Mo is your interactive partner, offering data-centric and AI-informed recommendations and explanations to help make faster and smarter decisions.

The outcomes speak for themselves: 15 hours saved each week on manual planning, 16% fewer stockouts across key SKUs, and 80% more accurate forecasts.

Moselle gives you the confidence to simplify forecasting and optimize replenishment — all while keeping your team focused on growth.

Ready to transform your forecasting? Build your first AI-powered forecast in minutes.